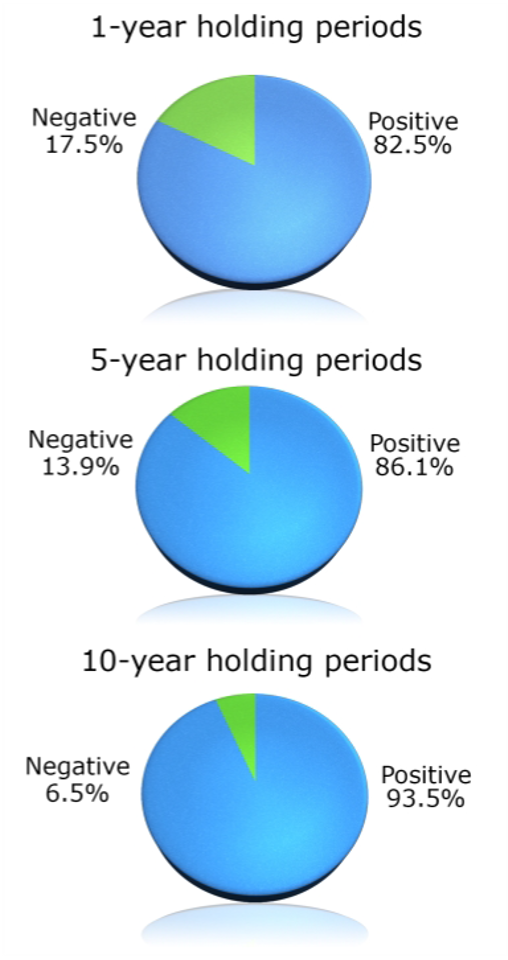

This quote has been around for years and is a commonly accepted adage. But does time really heal a wound? My perspective is that the movement on a clock or the turning of a page on a calendar has no inherent power to heal a wound. But for today’s perspective, let’s examine how this quote may apply to invest in. The trend toward instant gratification has taken a toll on our lives in many ways. One TV commercial displays a few touches on a smart phone and a mortgage is approved. Another ad shows 5 year olds trading stocks (for free of course) on their smart phones with nearly instant success. After all if trading is “free” shouldn’t we be doing more of it? “Speculating” can be viewed as making a guess on the short-term movement of a stock or investment. By contrast, “investing” involves the longer-term ownership of an investment. Which is better? It depends upon your objectives. Speculating can lead to significant potential gains…or substantial losses. Investing aims to smooth out the ride over the longer term. The chart may surprise you. ➞

For simplicity, the study references only the S&P 500 (one of our largest and most broad indexes of U.S. stocks). It compares the outcomes through different holding periods of 1 year, 5 years and 10 years. As you can see, the potential for success increases with time. We all know that past performance does not predict or guarantee future results. However, historical studies can provide potent lessons for today’s investor. Part of the challenge is revealed in other recent studies that reveal the average length of time investors hold mutual funds…15-17 months! This behavior pattern may reflect the instant gratification of active trading. Yet it may be at odds with the longer holding patterns that, historically, have improved the likelihood of a positive outcome. According to today’s media, one can obtain a mortgage approval in just a few clicks on their smart phone. Trading stocks appears so easy that several 3-5 year olds can do it from their high chairs. And that app on your smart phone doesn’t help either. You probably don’t have it set to give you the market returns of the past 3-5 years. Its more likely it provides the mostly useless information of what markets are doing today. Good luck matching that information with the accomplishment of your long-term goals. Instant gratification may come at the expense of long-term positive outcomes.

The following is a true story…with names changed to protect the anonymity of clients.

Kurt and Mary were recently married and saving aggressively for their first home. They both had good paying jobs and were on a fast track for home ownership. They approached me and asked if I would invest their funds. The markets had been performing well. This led to a level of confidence where they said, “We can take more risk than putting this in the bank and earning whatever interest they are paying on savings. I asked about their time frame for when they wanted to purchase their first home. “3-5 years was their answer.”

Over the ensuing period of time, the stock market went into free fall. Stock prices plummeted. Kurt and Mary approached me one day at church with overly concerned expressions. “Just how many years is it going to take us to get back to even so we can buy our house?” There is a tendency to want to take more risk when markets are performing well. But one of the reasons why stocks offer higher potential returns is the accompanying risk of periodic declines. “You can have your funds at any time. They have not been impacted by the market decline” I replied. They were astonished as though I had some magical power of clairvoyance. “How is that possible?” they asked. I explained to them that I chose to give more attention to their goal and time frame than their statement about being willing to take on additional risk. When a client needs funds within a 5 year period, stocks may not be the most suitable investment. Their funds had been invested in money market and bond investments and did not participate in the market decline. I’m not clairvoyant. I simply work to match the investment vehicle with the objective AND time frame of a client’s goals.

This case study does not constitute a recommendation as to the suitability of any investment for any person or persons having circumstances similar to those portrayed, and a financial advisor should be consulted for your specific situation. Actual performance and results will vary.

Brian Tracy is known for a quote: “There are no unrealistic goals; only unrealistic deadlines.” The success of an investment strategy will be less impacted by the data feed to your smart phone than by the patience we exhibit toward the potential for longer term success. “Time” may not heal all wounds. But for many investors, patience can be a virtue.

Image Source: Refinitiv, 2021. S&P composite total return for the period December 31, 1980 to December 31, 2020. Ranges consider the 40 one-year periods, 36 five-year periods, and 31 ten-year periods from 1981 to 2020.